Build a Sustainable Financial Future

Agency funds help nonprofits invest mission-critical dollars.

The Community Foundation offers nonprofit organizations a reliable, cost-effective option for long-term investments through agency funds.

In trusting the Community Foundation as your agency fund provider, you can expect

Low-Cost Investments

Low-Cost Investments

With billions in assets, the Community Foundation’s buying power offers access to low-cost investment pools for an organization’s reserve fund.

Flexibility

Flexibility

Access the assets in your organization’s fund at any time. Request distributions as often as you need.

Online Fund Access

Online Fund Access

Your staff, board or volunteers can view the fund’s balance, investment allocations, contributions and disbursements.

Support Team

Support Team

Our Agency Fund Support Team is available to help you navigate questions and can provide investment reports to your staff and board.

Should I set up an agency fund for my organization?

Agency funds are ideal for organizations that are ready to establish an account for long-term invested assets, separate from the organization’s day-to-day operating expenses.

The fund is assessed an administrative fee based on the assets in the fund. The minimum fee for an agency fund is $250 per year.

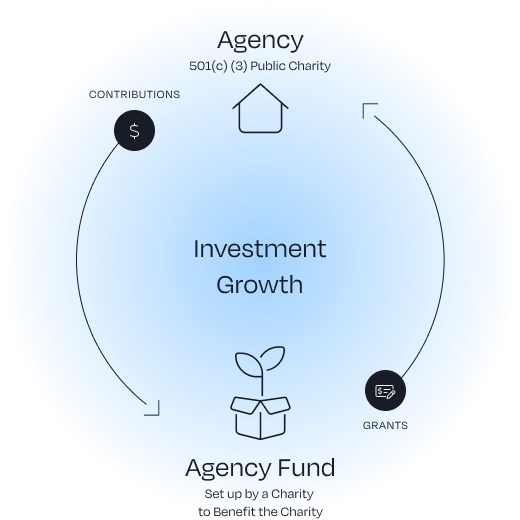

How an Agency Fund Works:

- Quickly and easily set up an agency fund with one simple document.

- Choose how to invest the fund’s assets.

- The Community Foundation receives contributions from the agency to the fund, and the Foundation processes disbursements from the fund back to the agency upon your request.

Disclaimer: Opening an agency fund does not increase the likelihood that a nonprofit organization will receive grants from Community Foundation funds, and nonprofits are not required to have an agency fund to receive grants from Foundation funds.